Bitcoin "Store of Value" problems: Supply Distribution and Control

Some proponents of Bitcoin claim it to be a store of value on par with gold. However, I see at least two glaring problems with Bitcoin that don’t affect gold.

Problem 1: Supply Distribution

As of Jan. 2021, the United States owns 261.5MM Troy oz. of gold [1], and the total world supply is roughly 5.6B Troy oz. [2] Therefore, the US controls 4.67% of the gold supply:

$$\frac{261.5\cdot10^6~\text{ozT}}{5.6\cdot10^9~\text{ozT}}\cdot100\%\approx4.67\%$$

Satoshi Nakomoto (the unknown person or persons who invented Bitcoin) is thought to own at least 1MM Bitcoin, and the supply is limited to 21MM by the Bitcoin protocol. [3] Therefore, Satoshi controls 4.76% of the supply:

$$\frac{1\cdot10^6~₿}{21\cdot10^6~₿}\cdot100\%\approx4.76\%$$

If Bitcoin were to seriously displace gold as a store of value, one unknown group or individual holding more value than the world superpower’s reserves is a huge liability.

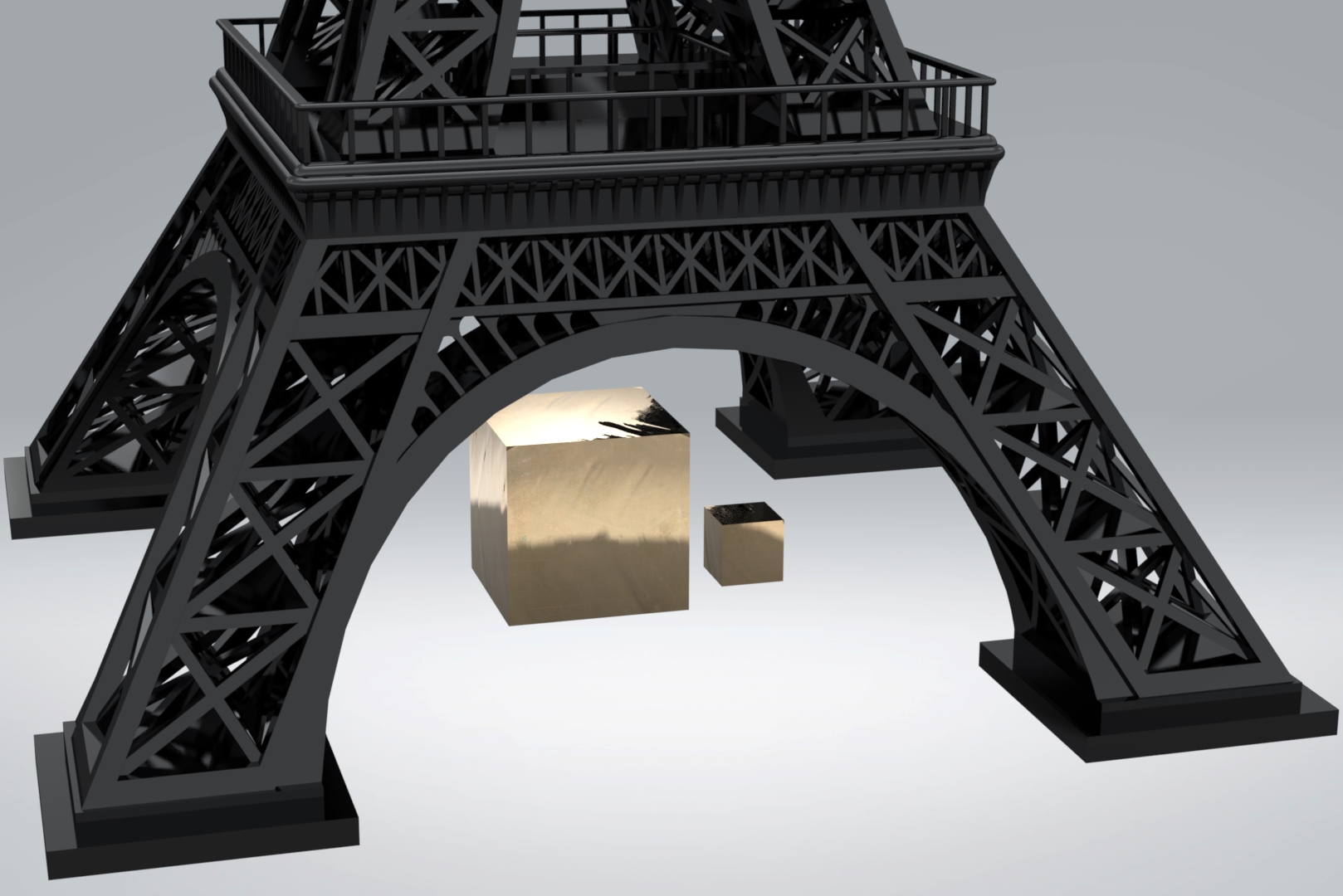

Comparison between Eiffel Tower, Global gold supply, and US gold reserves [8]

Problem 2: Manipulation of the Supply

In 2013, a new version of Bitcoin was released, which caused the blockchain to split between miners on the old and new version. [4] The developers coordinated with the miners to quickly revert to the old version so a fix could be published, but transactions were undone in the process (including a double-spend attack). If the developers and miners coordinated to undo transactions and modify the protocol, why couldn’t they change the protocol to raise the 21MM Bitcoin cap? Even without involving the developers, the protocol could also be modified by 51% of miners coordinating (51% attack). 65% of mining occurs in the People’s Republic of China as of 2019 [4]; couldn’t the CCP put a gun to the miner’s heads and force them to execute a 51% attack to destabilize the “global store of value”?

The supply of normal fiat currencies ($, €, ¥, etc.) can also be increased to an extreme level (Zimbabwe, Venezuela, Weimar Republic, et. al.), but the decision to do so is made by elected officials at the mercy of their home country. The value of those currencies also isn’t directly related to their scarcity; QE doesn’t necessarily imply inflation. [6] In comparison, Bitcoin is valuable due to its scarcity and its supply could hypothetically be changed by anyone with enough hashing power to execute a 51% attack (or if the developers go rogue).

Gold has existed for all of human history, and miners/geologists roughly understand how much exists in Earth’s crust. Unlike Bitcoin, it does have a small amount of inflation—roughly 2% [7]—which can’t be manipulated like Bitcoin due to the economic cost of mining. Large amounts of gold could be mined from asteroids, but there would still be an associated cost to produce it (unlike Bitcoin, which could be produced ad infinitum following a major attack).

[3] https://www.investopedia.com/terms/s/satoshi-nakamoto.asp

[4] https://bitcoin.org/en/alert/2013-03-11-chain-fork

[5] https://www.coindesk.com/highest-in-2-years-65-of-bitcoin-hash-power-is-in-china-report-finds

[6] https://www.economicshelp.org/blog/2900/inflation/inflation-and-quantitative-easing/

[7] https://www.bullionstar.com/blogs/ronan-manly/annual-mine-supply-gold-matter/

[8] Render by D. Richline. Eiffel Tower 3d model by Pranav Panchal

Last modified: 2021-02-28